1935

LUMP SUM DEATH BENEFIT: $96.93

The Lump Sum Death Benefit, or LSDB, makes its way all the way back to the original Social Security legislation of 1935. In 1935 Social Security did not pay out any survivor benefits, so if your spouse died, any payments going to the deceased stopped completely. To compensate, a LSDB was paid out in the amount of 3.5 % of the individual’s covered earnings. Although in 1935 the maximum payout could have been $315, actual payments were much lower, averaging $96.93 in 1939.

LUMP SUM DEATH BENEFIT: $145.79

In 1939 survivors benefits were introduced and the LSDB was subsequently discontinued. In its place, the current LSDB was introduced, with the intention that this would assist surviving family members when regular survivors benefits were not otherwise payable.

If there were no surviving family members, the LSDB could be paid to an individual who assisted with the burial expenses of the worker. Yes, you read that right! The benefit could go to a friend or worker who helped with the burial.

The amount of the LSDB was defined as 6 times the Primary Insurance Amount (PIA), or monthly Social Security benefit amount. The average LSDB payment in 1940 was $145.79. The minimum payment ever made under this 6X computation rule was $63.75 and the maximum payment $273.60.

1939

1950

LUMP SUM DEATH BENEFIT: $147.81

The 1950 Amendments lifted the restriction on the LSDB to cases where no survivors benefits were payable. After 1950, all deaths of covered workers were potentially eligible for the LSDB. Social Security monthly benefits increased by almost 80%, but the LSDB was kept almost level, by reducing the calculation from 6x the monthly Social Security benefit amount to only 3x the amount. This resulted in an average of $147.81.

LUMP SUM DEATH BENEFIT: $207.86 (Maximum $255.00)

The cap of $255 on the LSDB was introduced by law in 1954. Two years prior to this legislative change, the maximum LSDB was $255. In 1954, when Social Security was overhauled again, Congress decided that this was an appropriate level for the maximum LSDB benefit, and so the cap of $255 was imposed at that time.

This statutory cap on the LSDB has been in place since 1954. However, most people did not receive the maximum payment in 1954, and the average LSDB payment that year was only $207.86.

1954

1974

LUMP SUM DEATH BENEFIT: $255

By 1974 the lowest possible monthly benefit for Social Security payments had reached $85, and hence the lowest possible LSDB payment under the calculation reached $255 ($85 x 3). For the first time, you are guaranteed an amount equal to the $255 payment we know today.

LUMP SUM DEATH BENEFIT: $255

The benefit is still at $255, but friends or funeral homes who helped pay for the burial are no longer eligible to receive the payment. The payment may only go to a surviving spouse or child.

1981

2000

LUMP SUM DEATH BENEFIT: $255

The LSDB continues to stay at $255, a tradition dating all the way back to 1954. In 1935, the LSDB was equal to 3.5% of a person’s Social Security Benefit for one year. In 20161 it was equal to 0.03%. That is a reduction of 99.14%! Had Congress simply allowed the Lump Sum Death Benefit to keep pace with inflation, the benefit in 2020 would be $2,446.53. Interestingly enough, this would be enough to pay for a cremation and a few extras today.

The $255 Lump Sum Death Benefit is equal to about 2.5% of the cost of a burial and funeral service today. What does this mean? It is obvious that you cannot count on the government to pay for your burial expenses. Most Americans don’t have enough savings to pay for their burial costs. 48% of Americans have less than $10,000 in savings. More frightening, 35% of women have $0 in savings for retirement.

1 Zhe Li, Social Security Survivors Benefits (https://fas.org/sgp/crs/misc/RS22294.pdf), Congressional Research Center, 2019.

Rules & Regulations

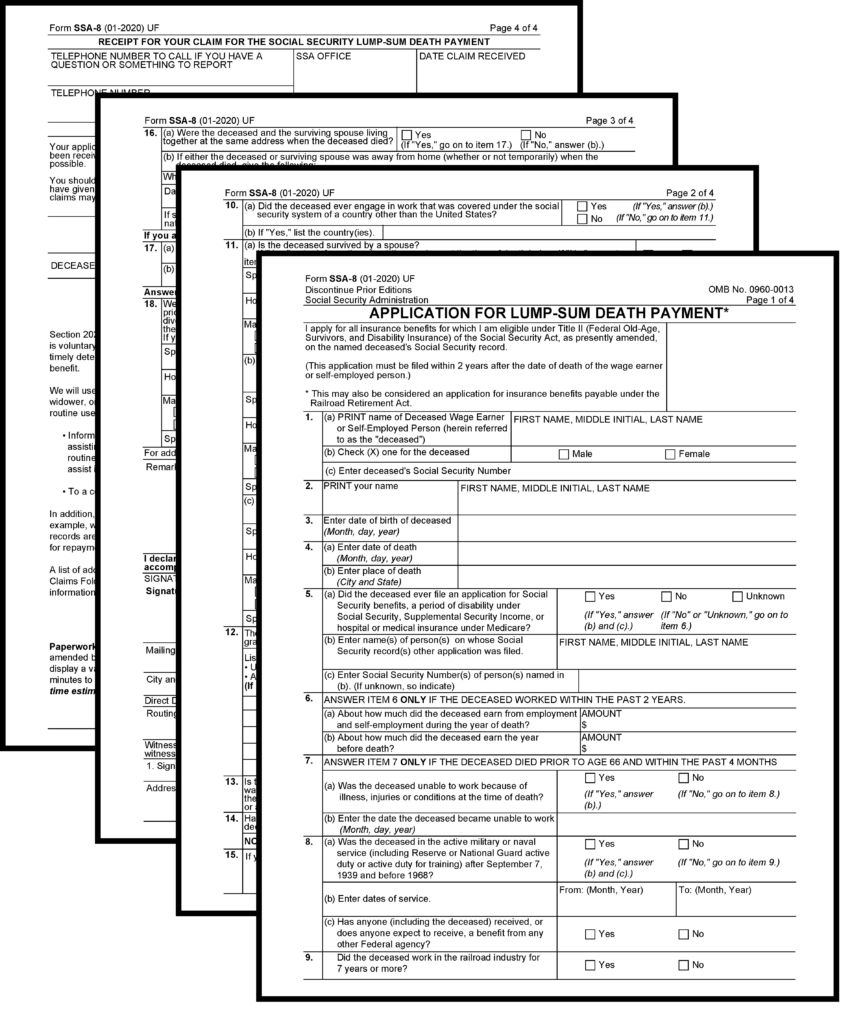

So, you think it is easy to receive your Lump Sum Death Benefit of $255 from the Social Security Administration? When your loved one dies, they will just automatically send you the check, right? Think again. As with anything with our government, you often have to jump through hoops and over hurdles to receive your check. In order to get your check, you must fill out Social Security Administration Form SSA-8, APPLICATION FOR LUMP-SUM DEATH PAYMENT, which happens to be 4 pages long. See the image at the right. Information can be found on the Social Security Website.

COMPLICATED

You guessed it. The rules can be complicated. Reviewing the following rules can make your head spin, and all of this for a $255 one time payment.

Requirements for Eligibility to Receive the LSDB

- 1.5 – 10 years of work

- widow/er 60 or older (50 if disabled)

- divorced widow/er 60 or older (50 if disabled)

- caring for child under 16 or disabled

- unmarried children up to 18/19 if full-time student

- disabled children under 22

- dependent parent(s) 62 or older

Required Information:

- applicant and decedent’s social security number proof of marriage or spousal benefit

- proof of worker’s death (DC or SSA-721)

- applicant and children’s birth certificates

- decedent’s W2 or federal tax return proof of support

- proof of divorce

- checking/savings account information for direct deposit

Elegibility

- countable resource limitation of $2000 for individual and $3000 for a couple

- burial funds up to $1500 each plus burial space expenses are excluded

- income and accruals on burial funds and burial space are excluded

- assets in “burial fund” and “burial space” must be segregated

- An irrevocable contract for final disposition, including income from the contract, is, not considered a resource. –huh?

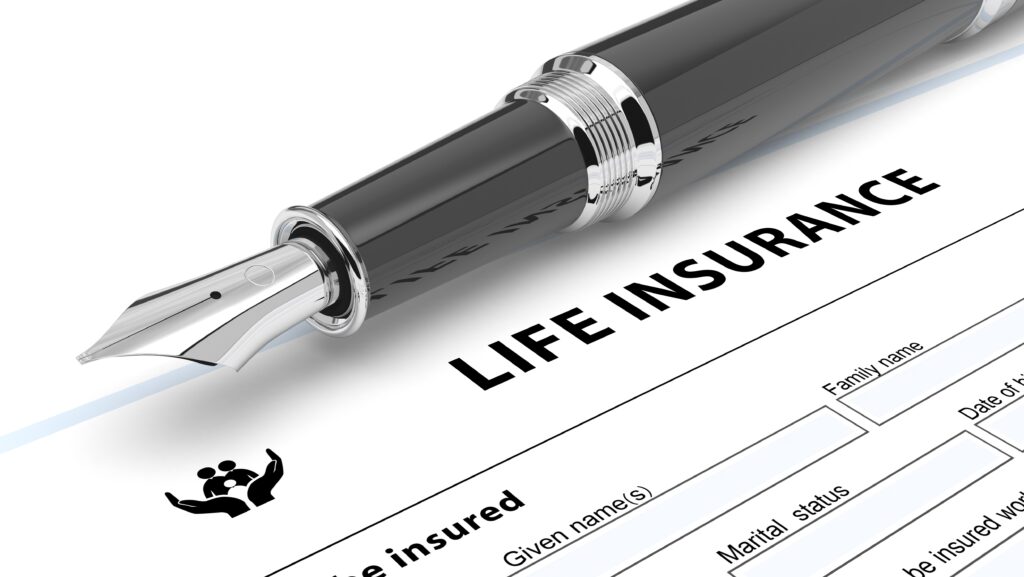

SETUP YOUR PLAN OF ACTION

What can you do to ensure you have enough to pay for your final expenses, whether that be a cremation or burial? If you haven’t managed to save enough by now, it will likely be very challenging to save enough by the time you die to prevent friends and family from having to start a GoFundMe account to pay for your burial.

The best way to solve the problem is to start now – and stay consistent. Determine your budget and save the same amount every month, no matter what. Setup autodraft on your bank so you get used to the money being transferred from your checking into your savings. And while you’re at it, why not consider redirecting the amount you have budgeted for your monthly savings and using it to purchase a final expense life insurance policy?

CONSIDER THIS

A 60 year old female has a life expectancy of about 85 years old. You could begin saving $60 a month right now, and by age 85 you would have saved $18,720. Due to inflation, a $10,000 funeral today will be expected to cost about $21,000 in 25 years, so that $60 a month savings would almost pay for your funeral – if you don’t die before age 85.

What if, instead, you put $60 a month into a life insurance policy? A 60 year old female can get $20,000 of coverage for as little as $60 a month. What is the benefit? You take TIME out of the equation. No one knows when they are going to be called upstairs, but we do know it is going to happen. Locking in a $20,000 final expense life insurance policy today guarantees that from Day One you are covered and have enough to pay for your burial costs, whether you die next week or next decade. In short, the Social Security death benefit will not be enough to cover your final expenses, but a whole life insurance policy can carry the weight of paying for your final expenses.

I found your blog using msn. This is a very well written article. I’ll be sure to bookmark it and return to read more of your useful information. Thanks for the post.

Hey there! I’ve been following your blog for a long time now and finally got the courage to go ahead and give you a shout out from Huffman Tx! Just wanted to tell you keep up the excellent job!