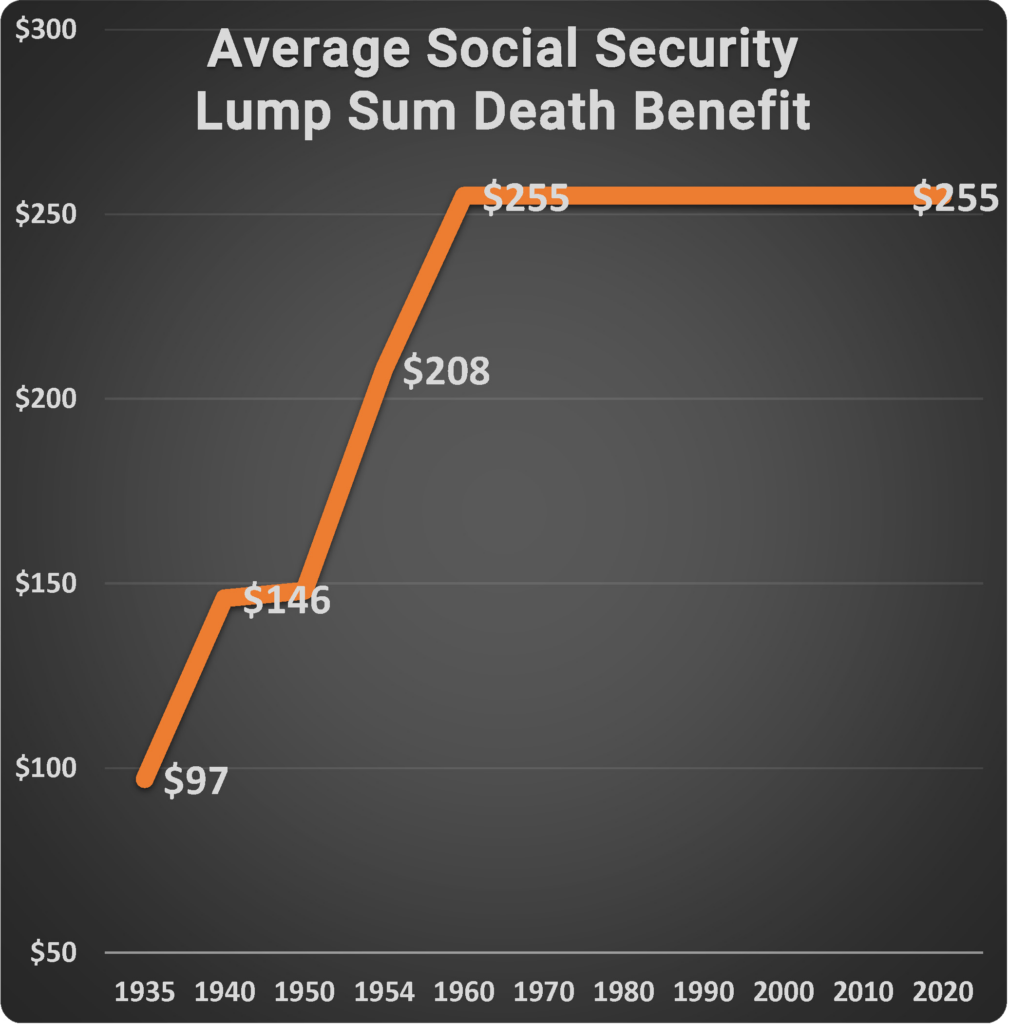

Beginning in 1935, Social Security paid a maximum amount of $315 as a lump sum death benefit. However, due to the way the benefit was calculated, the average payment was only $97.

Since the 1950s, the Social Security Administration has contributed a maximum death benefit in the amount of $255 to every senior who fits within the guidelines issued by the Social Security Administration. This benefit is subsidized by Social Security, and in many cases could take as long as 3 months to even receive a payment. As you are certainly aware, $255 will barely make a dent in the smallest of final expense plans!

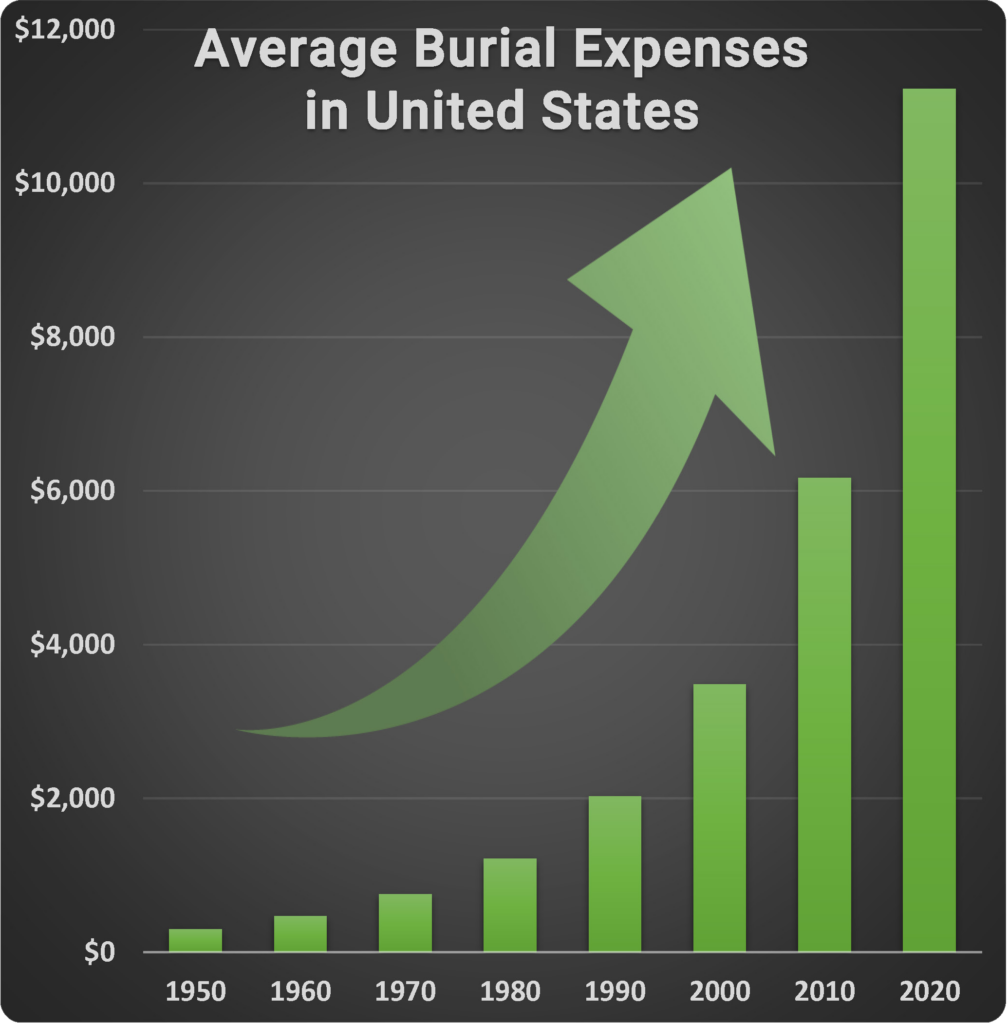

Almost 70 years later, the cost of a burial in most states has climbed over $9,000 once you add up these necessary expenses at the time of death.

Funeral homes expect their money quickly, and most seniors on a fixed income find themselves struggling to pay the rising cost of a sudden funeral bill for a spouse or loved one. In many cases, seniors living on social security may immediately lose up to 50% of their household income as soon as either spouse passes away.

This doesn’t have to happen. Seniors! You have options that you are entitled to know about, and we can help you understand them better.

If you are between the ages 50-85, you may qualify for favorable pricing for Final Expense Coverage that is completely affordable, and designed to pay the entire cost of a burial up to $15,000 in one tax-free payment to a beneficiary of your choice.

QUALIFYING IS SIMPLE!

- No medical exams required

- Affordable monthly premiums

- Same day approvals

- Tobacco users accepted

- Personal representative

- Guaranteed benefits

Click the Learn More button to receive your free copy of the 34 page booklet, “My Final Wishes Planner” to assist in conveying your wishes to your family and friends.

I understand and I agree that by submitting my information, a licensed insurance representative will contact me for the purpose of providing additional information on life insurance programs available in my state.